General Claim Info: It also Pays to Be Aware...

Words have meaning

Whenever you file a property damage claim, your carrier assigns their own paid adjuster to investigate your claim. A common reason to deny a loss is due to “wear and tear.” If you loosely misdescribed your loss with words like “rotted,” “deteriorated,” "repetitious," etc., you may have inadvertently provided the carrier an excuse to deny your claim based on your own misstatement.

Rot and deterioration are ongoing conditions that can only happen over time. A valid claim must be incidental, occurring at a specific time and date. Every claim is defined with a "Date of Loss." The date helps identify the loss along with the assigned claim number and specific cause, which must be covered by the policy.

Every inch, nook and cranny

When a company adjuster inspects your loss, he or she is looking to avoid or at least minimize the cost. You can’t assume that their photos taken will be aimed at a full and fair assessment of your claim. It’s important to point out each stain, scratch or defect in every adjacent room no matter how small or insignificant they may seem. Generally, policies cover for matching to return your home to its pre-loss condition. Maintaining your own photos of the damage is always a good idea. Your specification of visual damage can help expand the scope of your loss and could be the difference between thousands of dollars.

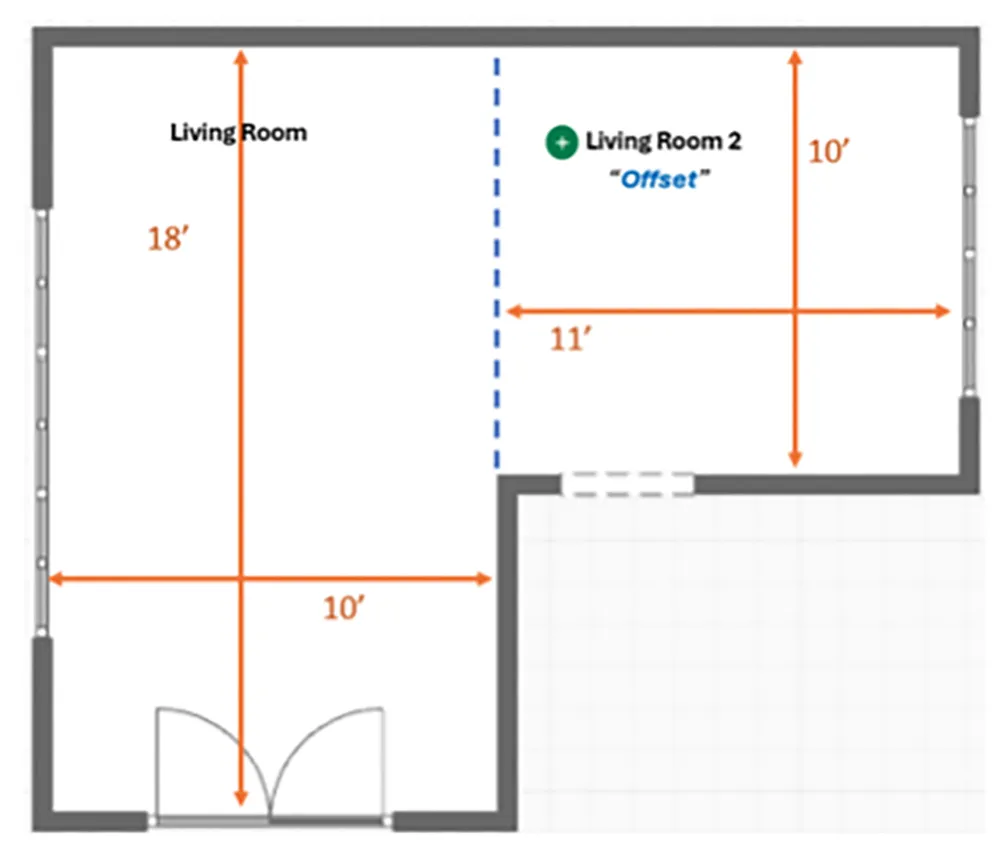

When it comes to size and space, all rooms were not created equal. To get to the best "approximate dimensions," simply measure the widest rectangle in each room. Rooms with two or more sizeable rectangles, should be handled as an "offset" or added sub-room. For example, one L-shape Living Room could be split and entered separately as "Living Room 1" plus + "Living Room 2," writing the word "offset" next to the added room title on your report.

Continuous Walls and Floors

When two connected rooms transition with matching walls or floors without a divider like trimming or molding, the rooms are considered continuous and should be mutually measured for scope even though only one room contains damage.

For example, if the living room hardwood floor is stained, and is continuous with the dining room, flooring for both rooms would qualify to be refinished. The homeowner should add in the dining room with a damaged floor as part of the claim.

If the walls were continuous (without a divider/trim) for adjoining rooms, both rooms should be measured (for painting) and added as damaged walls even though only one adjoining room shows damage.

Line-Item Estimate vs. Lump-Sump Estimate

A lump-sum estimate is when a contractor charges a single fixed price for an entire project. For example, the repair of the kitchen, living room and bathroom are all lumped together at one price. Specific repair cost and pricing are not presented on the estimate. Lump-sum estimates are not regarded as applicable in the adjustment of a claim.

A line-item estimate breaks down each cost of repair individually, which is the standard in the adjustment of any property damage insurance claim. ClaimCOMPS estimates are line-item based as standard for claims in the industry. Two opposing line-item estimates can be compared apples to apples to ideally sort out any material differences.

Emergency Mitigation Service - EMS

As an insured, policy terms obligate you to mitigate the damage to your home. Failure to make reasonable mitigation efforts could be cause for denial. Placing a temporary tarp over your roof or hiring a plumber to stop a pipe leak are examples of mitigation. However, specialized remediation may be necesary to eliminate extensive problems like mold and smoke altogether.

Remediation companies are usually paid directly and are not considered as part of your building repair estimate. It’s wise to select and consult with your own unbiased EMS company to determine the scope of damage and ensure that the job is properly completed.

Personal Content Loss

As opposed to dwelling, Personal Content loss is a separate coverage type of a policy that is not applicable to your ClaimCOMPS estimate. Yet, still these loss items should be listed, detailed and presented to the carrier with the opportunity to inspect before they are discarded.

Maintaining your own photos of these damaged items can help you prepare and substantiate your list.

The Public Adjuster

A Public Adjuster is an individual or firm that is retained to work on a commission basis as representatives on behalf of the homeowner to assist in the processing and valuation of property casualty claim. Public Adjusters negotiate and counter using detailed-line-item analysis. However, many publlic adjuster are only willing take on large value claims, such as fires and extreme loss that produce high compensation for their service.

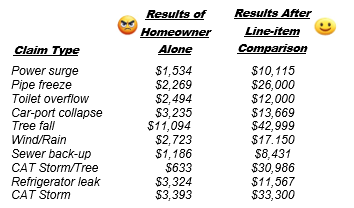

Some carriers even suggest that public adjusters are not needed for smaller claims, describing them as straight-forward, not justifying the cost of a 10-30% commission fee. However, below is a typical example of a puplic adjuster, who shares a sample performance list with new small claim prospective clients.

Without representation, smaller claims are more easily undermined because there is no oversite or skillful challenge throughout the process of the claim. An experienced insurance adjuster can misuse complex policy language to unfairly minimize your claim. In this tiny sample provided of 10 claims alone, the carrier would have avoided paying $174,032 on the so called “straightforward smaller claims” if help was not obtainable. Having your own comparative baseline-item estimate will strengthen your position to obtain an acceptable outcome for your claim.

A seasoned Public Adjusters will also review the applied Holdback Depreciation. Most settled claim payouts are partially reduced by 10-30% for depreciation due to the age of your home or latest improvement of the affected area. The amount held back can be recovered once your repairs are completed with receipts / bills supporting the unpaid difference. However, it’s important to know that a holdback as high as 40-60% may be questionable as excessive without justification. A recent 3-year-old paint job is a good reason to have excessive holdback depreciation disputed and reduced.